Having a Swedish ID Card – a so-called ID–Kort – will make your life in Sweden a lot easier as you will need it all the time – when picking up packages from the post office or when you wish to open a Swedish bank account.

From September 2017 the Swedish Tax Agency’s identity card looks like this:

Be registered as living in Sweden (have a personnummer).In order to get an ID card you must:

- Be at least 13 years old.

- Have your parent/guardian’s approval if you are less than 18 years old.

A Swedish ID card is not valid as identification when travelling in the EU. For international travel, you need a National ID card or valid Passport, which you get at any passport office in the country.

How to apply?

The process of applying is as follows:

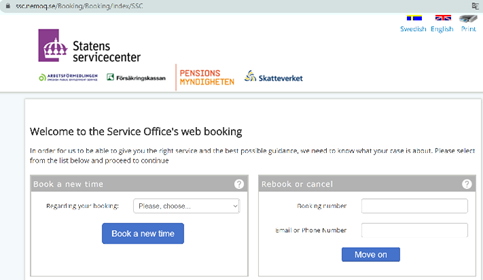

1. Make an appointment at the Tax Office website.

You can apply for an ID card at some of the Swedish Tax Agency’s service offices. Before you come to the service office, make an appointment for the visit. It is possible to pick up your ready-made ID card at some other service offices that do not issue ID cards.

2. Pay the application fee.

Start by paying the fee of 400 SEK. Remember to print and bring the receipt of the payment or you will have to wait until the payment reaches the Swedish Tax Office. Make your payment to the following accounts:

- Bankgiro 389-0100

Remember to quote your personnummer (personal identity number) in the field for messages/other information.

If you prefer to pay from abroad, you will need the following codes:

- IBAN): SE55 1200 0000 0128 1012 1613

- Swift/BIC: DABASESX

Do not forget to state your personal identity number in the OCR field (as a reference number) or message field if you pay via internet banking. If you use a paying-in form or if the payment is made at a kiosk or similar place that offers giro payment, you must state your personal identity number when paying.

Remember that it takes at least 1 working day for your payment to arrive at the Tax Agency. Therefore, pay the fee well in advance of your visit to the Tax Agency to ensure that they have received it before you apply. Print out and keep the payment receipt, as you need to show it when you visit the Tax Agency office. If you pay via the internet, remember to quote your personal identity number in the field for messages/other information.

3. Go to a Tax Agency offices that issue an ID card.

4. You do not need to bring a photograph as you will be photographed at the tax office.

5. Your local home address in Sweden (Rental contract).

6. At the tax office, you must make an Electronic application.

7. Bring papers to prove your identity.

Prove your identity through an approved ID document (mostly a passport). You have two options if you lack an approved ID document. The first option is to bring your Swedish residence permit with you and allow the Tax Agency – Skatteverket to compare the information in your residence permit with the information in your application.

How to obtain the ID card once it is ready?

Typically, it takes about two weeks from the time you apply for the ID card until it is ready to be picked up at the Tax Agency. However, it may take more time if it is necessary to further investigate certain information in your application. Once the ID card is ready, you will receive a letter “Aviseringsbrev” from the Tax Agency. You need to bring this letter when you collect the ID card from the Tax Agency.